Overview At the end of January, Facebook chose select advertisers to participate in a beta offering for Ads in Instagram Stories bought on the reach objective. Ads in Instagram Stories dynamically appear between user stories, much like Snap ads on Snapchat. On 1 March...

Overview

At the end of January, Facebook chose select advertisers to participate in a beta offering for Ads in Instagram Stories bought on the reach objective. Ads in Instagram Stories dynamically appear between user stories, much like Snap ads on Snapchat.

On 1 March 2017, Facebook announced that it will roll out Ads in Instagram Stories globally over the next few weeks. Over the coming months, Facebook plans to expand upon this product by offering additional objectives, which will include video views, website clicks, website conversions, and mobile app installs/engagement. They also plan to introduce links in Instagram Stories, which will include all available calls to action within the Instagram feed.

Below, you’ll find an overview and recommendations about the initial, promising performance of the new placement.

Analysis

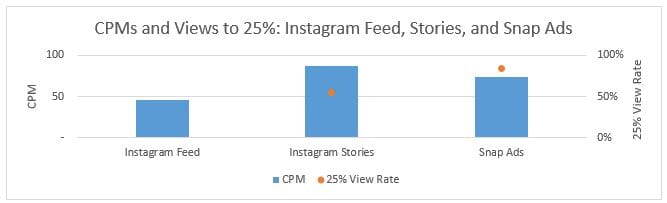

We evaluated the performance of ads in Instagram Stories beta performance against both Snap Ads and standard Instagram Feed ads. Snap Ads are the unit most comparable to Ads in Stories, as both display between user stories (though Snap Ads recently expanded to include additional placements as well) and feature full-screen vertical video of similar lengths (Snap Ads: 3-10 seconds, Instagram Stories: 3-15 seconds). We included Instagram Feed ads in our comparison to show how the two Instagram placements vary. We examined performance in terms of CPM (cost per 1,000 impressions), 25% View Rate (views to 25% / impressions) and CPCV (cost per completed view).

Initial Results

From a CPM perspective, Snap Ads and Instagram Feed ads cost less than Instagram Stories. Beyond CPM differences for these placements, user behaviour varies significantly between Snap Ads and Ads in Instagram Stories. Snap Ads delivered higher 25% View Rates than Instagram Stories despite the similar format, showing that cloning a feature from one platform to another does not necessarily mean that users will interact with it in the same way.

Overview

At the end of January, Facebook chose select advertisers to participate in a beta offering for Ads in Instagram Stories bought on the reach objective. Ads in Instagram Stories dynamically appear between user stories, much like Snap ads on Snapchat.

On 1 March 2017, Facebook announced that it will roll out Ads in Instagram Stories globally over the next few weeks. Over the coming months, Facebook plans to expand upon this product by offering additional objectives, which will include video views, website clicks, website conversions, and mobile app installs/engagement. They also plan to introduce links in Instagram Stories, which will include all available calls to action within the Instagram feed.

Below, you’ll find an overview and recommendations about the initial, promising performance of the new placement.

Analysis

We evaluated the performance of ads in Instagram Stories beta performance against both Snap Ads and standard Instagram Feed ads. Snap Ads are the unit most comparable to Ads in Stories, as both display between user stories (though Snap Ads recently expanded to include additional placements as well) and feature full-screen vertical video of similar lengths (Snap Ads: 3-10 seconds, Instagram Stories: 3-15 seconds). We included Instagram Feed ads in our comparison to show how the two Instagram placements vary. We examined performance in terms of CPM (cost per 1,000 impressions), 25% View Rate (views to 25% / impressions) and CPCV (cost per completed view).

Initial Results

From a CPM perspective, Snap Ads and Instagram Feed ads cost less than Instagram Stories. Beyond CPM differences for these placements, user behaviour varies significantly between Snap Ads and Ads in Instagram Stories. Snap Ads delivered higher 25% View Rates than Instagram Stories despite the similar format, showing that cloning a feature from one platform to another does not necessarily mean that users will interact with it in the same way.

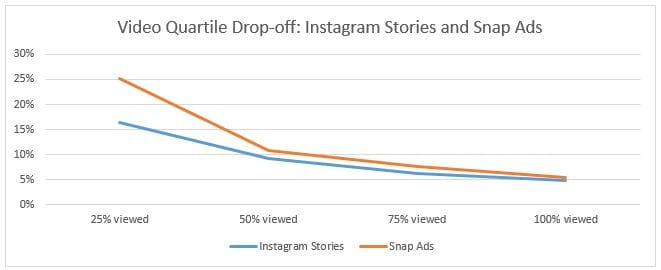

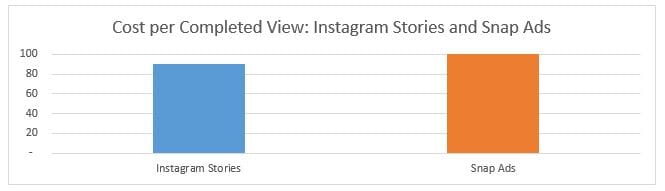

The 25% View Rate shows only initial engagement with a video ad unit, so we examined the drop off between quartiles to determine the extent of sustained user engagement. Snap Ads drop off more significantly from the start, but both placements see comparable declines beyond the 50% viewed mark.

While CPMs are currently more efficient and the initial view rate is higher on Snap Ads, there is less drop-off throughout videos on Instagram Stories and an overall lower CPCV.

Marketplace Evolution

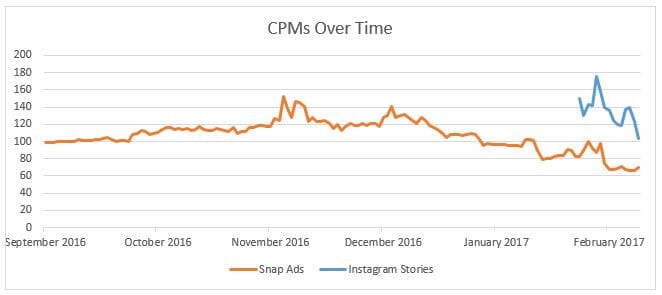

Efficiencies were strong during the alpha phase of Snap Ads as only a few advertisers were in-market. As more advertisers entered the auction, costs rose, but then fell upon the roll-out of additional placements. Similarly, Instagram Stories saw a spike in CPM as more advertisers entered the marketplace, but trended downward as the beta continued and Facebook released more inventory on the supply side.

However, it’s important to note that these metrics aren’t final and will evolve as the marketplace changes because of the nascent and volatile nature of these marketplaces and dynamic pricing. Factors such as advertiser adoption of these formats, the ad load set by the platforms, as well as the introduction of placement optimisation and goal-based bidding will have an ongoing effect on pricing.

Potential for the Future

There are several considerations that may significantly impact the future for both Snap Ads and Instagram Stories:

Reach/Scale

Per the most recent stats released by Facebook and Snap Inc., there is comparable global scale on both platforms, with 150MM Daily Active Users on Instagram Stories vs. 158MM Daily Active Users on Snapchat. Instagram has 400MM Daily Active Users globally, which means that Stories has 250M users of headroom before saturating the existing Instagram user base and appears to have more immediate potential for growth. This prediction holds at a global scale.

Once placement optimisation rolls out, advertisers will be able to report and optimise towards de-duplicated reach on Instagram Stories with other Facebook and Instagram placements. We expect to see greater efficiency with Ads in Instagram Stories once placement optimisation and further objectives become available. Coupled with the audience size on Facebook and Instagram vs. Snapchat, this is extremely valuable.

However, Snapchat released stats in partnership with Nielsen that show 57% of 18- to 34-year-olds use Snapchat rather than Instagram daily and 23% use Snapchat and not Facebook. While these stats were pulled in September 2015 long before the release of Instagram Stories, they may still indicate that complementing an Instagram Stories buy with Snap Ads could be a valuable strategy for increasing overall reach.

Bidding for Objectives

Snapchat announced goal-based bidding for both impressions and swipes in late 2016, which allows advertisers more flexibility and efficiency in their buys based on their goal. Facebook plans to roll out several new objectives for Instagram Stories in the coming months, including video views, website clicks, website conversions, and mobile app installs/engagement.

Snapchat currently has goal-based bidding for impressions and swipes, where swipes are used for campaigns with a goal of long-form video completion, app installs, or website clicks. Similarly, the more precise objectives that Facebook will roll out for Instagram Stories will likely show greater efficiency towards advertiser’s goals, as users can buy directly towards longer form video completion, app installs, or website clicks rather than optimising towards swipes for a variety of second step actions on Snap Ads. Additionally, when Facebook offers a video view objective, this will include 10-second video view bidding, which will effectively be completed view bidding for videos 10 seconds or less (15 second maximum).

Measurement

Both Instagram and Snapchat provide Nielsen, Millward Brown, and Datalogix measurement options for brand lift, resonance and digital ad ratings. Facebook also offers some lower-cost native brand and conversion lift study options.

In Summary

While similar to Snap Ads, Ads in Instagram Stories should provide heavy competition to the market from an efficiency, targeting, and scale perspective. However, these initial results only reflect media metrics and don’t speak to ad effectiveness against overall campaign objectives like brand outcomes or offline sales.

We look forward to running measurement studies both for Snap Ads bought programmatically and Ads in Instagram Stories, which will give us better insight into the placements’ relative strength at driving business outcomes for our clients. In the meantime, advertisers should aggressively test and experiment with both products in order to see what works best for them.

Purpose built for Performance Digital Media

So much of the creative that gets used in digital media is not created specifically for the channel it runs on, which often causes it to perform poorly, effecting campaign ROI. At Resolution Digital we focus on making creative that works natively for TikTok, Facebook, Instagram, YouTube and the many various formats they have. So make sure your creative is working hard to maximise your digital media ROI. Speak to Resolution about our Digital First Creative.

.svg)

.svg)

.svg)

.svg)

.jpg?cw=376&ch=240&crop.type=poi)